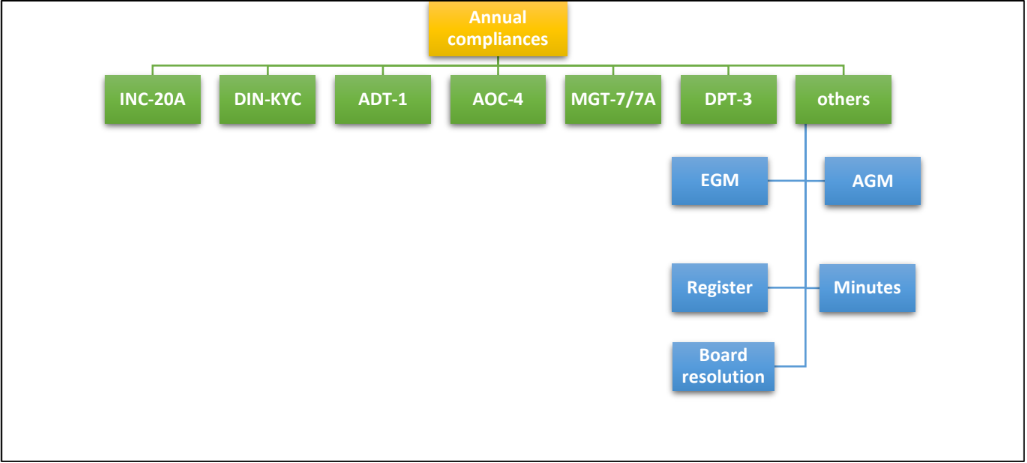

Compliance refers to the act of adhering to laws, regulations, standards, or guidelines. Compliances refers to the process of ensuring that a company or organization follows all applicable laws, regulations, and all internal policies that governs its operations. Annual compliances of private limited company encompasses a range of regulatory obligations that the company must fulfill on an annual basis to ensure legal compliances, transparency and accountability to its operations.

Annual compliance of Private Limited Company

What is Private limited company?

A private limited company is a privately held business entity held by the group of small private stakeholders. It is a type of privately held small business, in which owner liability is limited to their shares and shares are prohibited from being publicly traded. It is a legal entity separate from its owners. A Private Limited Company, ownership is divided into shares, and shareholders are not personally liable for the company’s debts beyond their share capital contributions. A private limited company enjoys legal separation from its owners and necessitates a minimum of two members and two directors for its operation.

MCA annual compliances for private limited companies

INC-20A

INC-20A is a form prescribed under the Companies Act, 2013 in India. INC-20A form is used to declare that the company has commenced its business operations. It ensures that the company has met the statutory requirement of receiving the minimum subscription amount from shareholders before starting business activities. Please note it is filed once in the lifetime of the company.

.png) Timeline:

Timeline:

Companies are required to file INC-20A within 180 days from the date of Incorporation.

.png) Fees structure:

Fees structure:

Fees will be payable according to the capital of registered company.

| Capital | Fees |

|---|---|

| Less than 1,00,000 | 50 |

| 1,00,001-5,00,000 | 100 |

| 5,00,001-10,00,000 | 150 |

| 10,00,001-25,00,000 | 200 |

| 25,00,001-1,00,00,000 | 400 |

| Above 1,00,00,000 | 600 |

.png) Late fees and

Penalties:

Late fees and

Penalties:

Failure to file INC-20A within the

stipulated time can lead to

penalties on both

The company and directors.

Late fee depends upon the number of days delayed in filing of

INC-20A after stipulated

Time period of 180 days’ has been lapsed.

| Number of days delayed | Late fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days-up to 60 days | 4 times of normal fees |

| More than 60 days-up to 90 days | 6 times of normal fees |

| More than 90 days-up to 180 days | 10 times of normal fees |

| Above 180 days | 12 times of normal fees |

If INC-20A not filed within stipulated 180 days’ time and additional given 180 days extended time, the penalty of Rs.50000 will be imposed on company and also Rs.1000 penalty will be charged on director on per day basis. (Please note the maximum limit of Penalty charged on director is up to 1 Lakh). The company name can also be stuck off by the MCA if this compliance not followed.

DIN-KYC:

DIN-KYC (Director Identification number – know your customer) is a regulatory process required mandated by the Ministry of corporate Affairs (MCA) in India after the end of every financial Year (31st March). Its primary purpose is to ensure transparency and accountability in corporate governance. This process involves verifying the identity and address details of directors.

.png) Applicability:

Applicability:

The DIN-KYC process is applicable to all individuals who have been allotted a Director Identification number (DIN) by the MCA.

.png) Purpose:

Purpose:

DIN-KYC process aims to ensure the authenticity of the designated partners and prevent fraudulent activities within company.

1. Transparency and Accountability:

DIN-KYC promotes transparency within the company by ensuring that the identities of the directors are accurately documented and verified. This enhances the credibility of the company and instills confidence among stakeholders, including investors, creditors, and business partners.

2. Prevention of Fraud:

By conducting DIN-KYC, the authorities can verify the authenticity of directors, thus reducing the risk of fraudulent activities within the company. Verifying the identities and backgrounds of directors helps in maintaining the integrity of the company structure.

3. Regulatory Compliance:

The DIN-KYC process ensures compliance with regulatory requirements mandated by the Ministry of Corporate Affairs (MCA) in India. It helps verify the identities of designated partners and ensures that only eligible individuals hold such positions.

.png) Timeline:

Timeline:

DIN-KYC must be done after 31st March and before 30th September every year.

.png) Fees:

Fees:

There is no government fees applicable for DIN-KYC.

.png) Late fees:

Late fees:

If form not filed before 30th September then after 30th September the DIN get deactivated by the MCA department and fees of Rs.5000 is charged from the director in form of late fees.

ADT-1:

ADT-1 is a form prescribed by the Ministry of Corporate Affairs in India. It used to inform the ROC about the appointment of an auditor for a company.

.png) Who can be an

auditor of a company?

Who can be an

auditor of a company?

A qualified Chartered accountant or a firm of chartered accountants can be an auditor of a company.

.png) What are the

qualifications of an auditor?

What are the

qualifications of an auditor?

1. An auditor must be a qualified

chartered

accountant or a member of a recognized accountancy

body.

2. An auditor must have experience in auditing financial

statements, accessing internal controls,

and have well knowledge of accounting principles.

3. The auditor being registered with the appropriate regulatory

body, such as Institute of

Chartered accountants of India (ICAI) for Indian companies is

mandatory.

.png) Applicability

of

ADT-1:

Applicability

of

ADT-1:

ADT-1 form is applicable for all companies registered under the companies act, 2013 in India.

.png) Timeline:

Timeline:

Form ADT-1 must be filed with the ROC within 15 days from the date of appointment of the auditor at the company’s general meeting.

.png) Fees:

Fees:

The fees applicability is depending on the authorized share capital of the company.

| Capital | Fees |

|---|---|

| 0 - 1,00,000 | 200 |

| 1,00,001 – 4,99,999 | 300 |

| 5,00,00 – 24,99,999 | 400 |

| 25,00,00 – 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

.png) Late fees:

Late fees:

Late fee depends upon the number of days delayed in filing of ADT-1.

| Number of days delayed | Late fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days-up to 60 days | 4 times of normal fees |

| More than 60 days-up to 90 days | 6 times of normal fees |

| More than 90 days-up to 180 days | 10 times of normal fees |

| Above 180 days | 12 times of normal fees |

AOC-4:

AOC-4 form is a prescribed document by the Ministry of Corporate Affairs (MCA) in India. AOC-4 is used to filing financial statements such as Balance sheet, Profit & Loss A/C, Cash flow statement etc. By the companies with the Registrar of Company (ROC) annually.

.png) Applicability of AOC-4:

Applicability of AOC-4:

Form AOC-4 is applicable to all types of companies registered under the Companies Act, 2013, including private companies, public companies, and one-person companies (OPCs).

.png) Timeline:

Timeline:

The AOC-4 form must be filed with the ROC within 30 days from the date of Annual general meeting (AGM) of the company.

.png) Fees:

Fees:

The fees applicability is depending on the authorized share capital of the company.

| Capital | Fees |

|---|---|

| 0 - 1,00,000 | 200 |

| 1,00,001 – 4,99,999 | 300 |

| 5,00,00 – 24,99,999 | 400 |

| 25,00,00 – 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

.png) Late fees:

Late fees:

Late fee depends upon the number of days delayed in filing of AOC-4.

| Number of days delayed | Late fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days-up to 60 days | 4 times of normal fees |

| More than 60 days-up to 90 days | 6 times of normal fees |

| More than 90 days-up to 180 days | 10 times of normal fees |

| Above 180 days | 12 times of normal fees |

MGT-7 / 7A

MGT-7 form is prescribed document by the Ministry of Corporate

Affairs in India. It is also known as

Annual return. MGT-7 form is used by the companies to provide details

about their share capital,

Company’s financial position, indebtedness, governance structure, and

other important information

to the Registrar of Companies (ROC) annually.

MGT-7A form is prescribed document by the Ministry of Corporate

Affairs in India. MGT-7A form is

used for one person Company (OPC) and small companies to provide details

about their share capital, company’s financial position, governance

structure, indebtedness, and other more important

information to Registrar of Companies (ROC) annually.

.png) Applicability of

MGT-7/ 7A:

Applicability of

MGT-7/ 7A:

Form MGT-7 is applicable to all

types of companies registered

under the Companies Act, 2013,

including private companies, public companies, and one-person

companies (OPCs).

From MGT-7A is applicable for one person companies (OPC) and

small companies whose:

* Paid-up share capital not exceeding Rs.2 crore or such specified

higher amount shall

not exceed Rs.10 crore.

* Turnover not exceeding Rs.10 crore or such specified higher amount

shall not be more

than Rs.100 crore.

.png) Fees:

Fees:

The fees applicability is depending on the authorized share capital of the company.

| Capital | Fees |

|---|---|

| 0 - 1,00,000 | 200 |

| 1,00,001 – 4,99,999 | 300 |

| 5,00,00 – 24,99,999 | 400 |

| 25,00,00 – 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

.png) Late fees:

Late fees:

Late fee depends upon the number of days delayed in filing of AOC-4.

| Number of days delayed | Late fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days-up to 60 days | 4 times of normal fees |

| More than 60 days-up to 90 days | 6 times of normal fees |

| More than 90 days-up to 180 days | 10 times of normal fees |

| Above 180 days | 12 times of normal fees |

DPT-3

DPT-3 serves as a means for companies which is used for filling returns of deposits and details for outstanding loan or particulars of transactions not considered as deposits by the companies with the Registrar of Companies (ROC).

.png) Applicability:

Applicability:

DPT-3 form is applicable to all types of registered companies.

.png) Fees:

Fees:

The fees applicability is depending on the authorized share capital of the company.

| Capital | Fees |

|---|---|

| 0 - 1,00,000 | 200 |

| 1,00,001 – 4,99,999 | 300 |

| 5,00,00 – 24,99,999 | 400 |

| 25,00,00 – 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

.png) Late fees:

Late fees:

Late fee depends upon the number of days delayed in filing of DPT-3.

| Number of days delayed | Late fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days-up to 60 days | 4 times of normal fees |

| More than 60 days-up to 90 days | 6 times of normal fees |

| More than 90 days-up to 180 days | 10 times of normal fees |

| Above 180 days | 12 times of normal fees |

Others Compliances need to follow for Private limited company

.png) AGM

AGM

Annual General Meeting (AGM) is a mandatory yearly gathering of a company’s shareholders and directors in which various matters such as company’s performance, financial results, appointment of directors, appointment of auditor, Vote on important matters, and other important decisions are discussed and decided upon.

1. First AGM of New companies

The first AGM of a new company typically occurs within nine months from the end of the financial year in which company was incorporated.

2. Frequency

An AGM must be held by every company at least once every calendar year. The interval between two AGMs should not exceed fifteen months.

3. Notice Period for AGM

Shareholders must be notified of the AGM in advance, usually through a formal notice. The minimum notice period of 21 days is mandates by the Companies Act, 2013 in India.

4. Timing and locations

AGMs are typically held during the business hours on weekdays. AGMs can take place at the company’s registered office or headquarters, Conference centers or hotels in major cities etc.

5. Participation

Shareholders have the right to attend, vote and speak at the AGM. If shareholder is unable to attend the meeting he/she may appoint proxies to attend and vote on their behalf.

6. Quorum

Quorum refers to the minimum number of

members required to be present at

a meeting.

Quorum for Annual general meeting of a private limited is:

* Two members present at the meeting if the total number of members is

up to Five.

* Two members present at the meeting if the total number of members are

more than

five but up to hundred members.

* Five members present at the meeting if the total number of members are

more than

hundred.

.png) EGM

EGM

Extraordinary General meeting (EGM) is a meeting of a company's shareholders that is convened outside the regularly scheduled Annual General Meeting (AGM) to address specific urgent matters or matters that require shareholder approval.

1. Purpose

EGMs are called to discuss and vote on important matters that cannot wait until the next AGM.

2. Timings

Unlike AGMs, which are held annually, EGMs are held on an ad-hoc basis as and when required.

3. Notice Period

The minimum notice period of 21 days is mandates by the Companies Act, 2013 in India.

4. Quorum

* Two members present at the meeting if the total number of members is

up to Five.

* Two members present at the meeting if the total number of members are

more than

five but up to hundred members.

* Five members present at the meeting if the total number of members are

more than

hundred.

5. Minutes

Minutes in an Extraordinary general meeting (EGM) are concise, official records summarizing. The Discussions, decisions, and actions taken during the meeting, providing an accurate amount of proceedings.

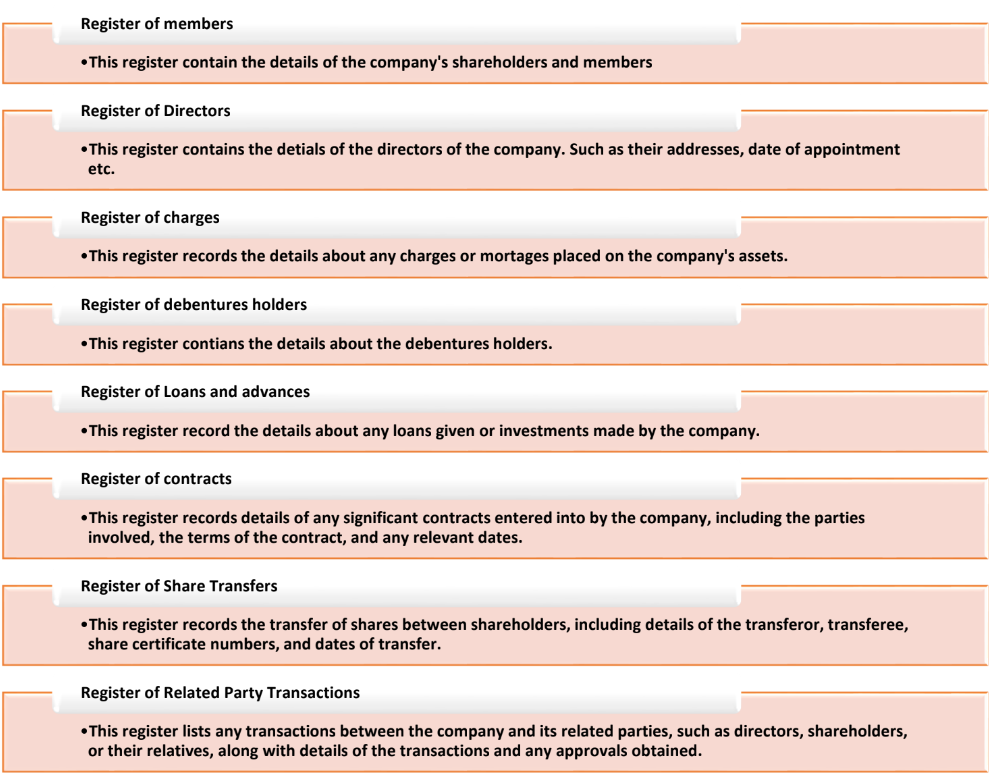

.png) Register of Private

limited company

Register of Private

limited company

In a company, various registers are maintained to comply with legal requirements and ensure accurate record-keeping of important company information. There are many types of registers prepared in a company:

.png) Minute’s books

Minute’s books

This book contains records of the

proceedings and resolutions passed at

the company's

shareholder meetings, board meetings, and committee meetings. Minutes

serve as a crucial

document for documenting and preserving the company's decision-making

process and ensuring

transparency and accountability.

1. Minutes books include the following information:

2. Date, time, and location of the meeting.

3. Decisions made, resolutions passed, or actions taken by the

participants.

4. Names of attendees, including shareholders, directors, officers, and

any other participants.

5. Details of any appointments, appointments, or elections conducted

during the meeting.

6. Any voting results, including the number of votes in favor, against,

or abstaining.

7. Any announcements, disclosures, or other important information shared

during the meeting.

.png) Board Resolution

Board Resolution

A board resolution is a formal decision or

directive passed by the board

of directors of a company

during a board meeting. It serves as a formal record of the board's

decision-making process and

outlines the actions or decisions taken by the board on behalf of the

company.

Board resolutions are usually documented in writing and signed by the

members of the board or

their proxies. They may also include specific details such as the date

of the resolution, the location

of the meeting, and the names of the directors present. Once passed,

board resolutions are legally

binding on the company and its stakeholders, and they may need to be

filed with regulatory

authorities or included in corporate records.

GST Compliances for Private Limited Company

GSTR 1

GSTR 3B

GSTR 9

GSTR-1

.png) Content:

Content:

* Details of outward supplies made to registered taxpayers (B2B supplies).

* Details of outward supplies made to unregistered taxpayers (B2C supplies)

where

. The invoice value exceeds Rs.2.5 lakhs.

* Summary of exports and supplies made to SEZs.

* Details of debit and credit notes issued during the reporting period.

* Amendments to invoices or credit/debit notes issued in previous periods.

.png) Due date:

Due date:

* For Monthly Filers: 11th of the following month.

* For Quarterly Filers: 13th of the month following the end of the quarter.

.png) Late Fees:

Late Fees:

* Late filing of GSTR-1 attracts a late fee of Rs.50 per day (Rs.20 for taxpayers having Nil Tax liability) subject to a maximum of Rs.5000.

GSTR 3B

.png) Content:

Content:

* Details of outward supplies (sales) including both taxable and exempt

supplies.

* Summary of inward supplies (purchases) including imports and purchases liable

for reverse

charge.

* Calculation of input tax credit (ITC) availed on purchases.

* Summary of tax liability including IGST, CGST, SGST/UTGST, and cess payable.

* Details of tax paid and any amount payable after adjusting the input tax

credit.

* Amendments to the previous months return if required.

.png) Due date:

Due date:

* The due date for filing GSTR-3B is typically the 20th of the following month. For example, the Return for the month of January is due by February 20th.

.png) Late Fees:

Late Fees:

* Failure to file GSTR-3B by the due date attracts a late fee of Rs.50 per day (Rs.20 for Taxpayers with nil tax liability) up to a maximum of Rs.5000.

GSTR 9

GSTR-9 is an annual return form that must be filed by registered GST taxpayers in India. It Consolidates the information furnished in the monthly or quarterly GST returns (GSTR-1, GSTR-3B) during the financial year.

.png) Types of GSTR-9 Forms

Types of GSTR-9 Forms

GSTR-9: For regular taxpayers under the GST.

GSTR-9A: For taxpayers opting for the GST Composition Scheme (This form

was phased out

After FY 2019-20).

GSTR-9B: For e-commerce operators who are required to collect tax at

source under GST.

GSTR-9C: A reconciliation statement, essentially an audit form for

taxpayers who’s annual

Turnover exceeds a specified limit. It is to be filed along with GSTR-9 and

audited by a

Certified professional.

.png) Due Date:

Due Date:

.png) Late fees:

Late fees:

A late fee of INR 200 per day (INR 100 under CGST and INR 100 under SGST) is Levied for delay in filing GSTR-9. However, there’s a catch: the late fee is subject to a Maximum of 0.25% of the taxpayer’s total turnover in the relevant state or union Territory.

Income tax Compliance for Private limited Company

Income tax is a direct tax levied on the income earned by individuals,

businesses, and other

Entities within a specific jurisdiction, typically by the government. It is one

of the primary

Sources of revenue for the government and is used to fund various public

expenditures,

Including infrastructure development, social welfare programs, defense, and

other essential

Services.

There are seven types of ITR but in case of Private limited company we have to

file two ITR

Returns; ITR-6 and ITR-7

ITR-6

ITR-6 is an income tax return form prescribed by the Income Tax Department of India for companies other than those who are claiming exemptions under section 11 of Income Tax Act, 1961

.png) Who should file ITR-6?

Who should file ITR-6?

1. Domestic companies

All domestic companies incorporated under the companies act, 2013 whose income are not exempted under section 11 of the Act are need to file ITR-6.

Domestic companies includes:

* Private Limited Companies.

* Public Limited Companies.

* One Person Companies (OPCs).

* Section 8 Companies (Non-Profit Companies), etc.

2. Foreign companies

Foreign companies operating in India through a branch or office whose income is not exempt under Section 11 are also required to file their income tax returns using ITR-6.

3. Other Corporate Entities

Other corporate entities, such as cooperative societies, local authorities, and other corporate bodies, whose income is taxable and not exempt under Section 11, should also file their income tax returns using ITR-6.

.png) Due dates

Due dates

The due dates for filing ITR-6 can vary depending on the entity’s circumstances and any extensions provided by the Income Tax Department. Generally, for entities requiring audit, the due date is usually September 31st of the assessment year. For those not requiring audit, the due date is typically July 31st of the assessment year. However, it’s important to check for any extensions or changes in due dates announced by the authorities.

.png) Late fees

Late fees

* If the taxpayer files the ITR after the due date but before December 31 of the

assessment

year, a late filing fee of ₹5,000 may be levied.

* If the taxpayer files the ITR after December 31 of the assessment year, a late

filing fee of

₹10,000 may be levied.

However, if the total income of the taxpayer does not exceed ₹500000 the maximum

late

filing fee will be restricted to ₹1000.

TDS Compliances for Private Limited Company

Tax Deducted at Source (TDS) is a method where tax is deducted from income (like salaries or interest payments) at the point of generation and directly remitted to the government. It ensures advance collection of taxes and reduces tax evasion, easing the tax payment process for the recipient.

.png) TDS Returns

TDS Returns

Form 24Q: This return is filed for TDS deducted on salaries.

Form 26Q: Filed for TDS deducted on all payments other than salaries.

Form 27Q: Used for TDS deducted on payments made to non-residents other

than salary.

Form 27EQ: Filed for TDS deducted on tax collected at source.

.png) DUE DATES OF TDS

DUE DATES OF TDS

TDS Deduction Due Date: Tax must be deducted at source at the time of

making specified

payments or credit to the payee’s account, whichever is earlier. The due date

for TDS deduction is

typically at the time of payment or credit, as per the provisions of the Income

Tax Act.

TDS Deposit Due Date: After deducting TDS, the deductor is required to

deposit the tax amount

with the government. The due date for depositing TDS is generally the 7th of the

following month,

except for March, where it’s typically April 30th.

TDS Return Due Dates: The deductor must file quarterly TDS returns

providing details of TDS

deducted and deposited. The due dates for filing TDS returns are as follows:

| Quarter | Months | Dates |

|---|---|---|

| Q1 | April-June | July 31 |

| Q2 | July-September | October 31 |

| Q3 | October-December | January 31 |

| Q4 | January-march | May 31 |

.png) Late fees

Late fees

* If a deductor fails to file the TDS return within the due date, they are

liable to pay a late filing

fee. As per Section 234E, the late fee is ₹200 per day for each day of default,

starting from

the day immediately following the due date of filing the TDS return until the

date of actual

filing of the return.

* However, the late fee cannot exceed the total amount of TDS deducted or

₹5,000, whichever

is lower. This means that even if the delay is substantial, the late fee cannot

exceed ₹5,000.

ESIC / EPFO Compliances of Private limited

.png) What is ESIC?

What is ESIC?

ESIC stands for the Employees State Insurance Corporation, which is a social security Organization in India established under the Employees State Insurance Act, 1948. ESIC provides a Range of benefits to employees, including medical, cash, maternity, disability, and dependent Benefits, to ensure their welfare and protect them against unforeseen contingencies such as Sickness, maternity, temporary or permanent disablement, and death due to employment injury.

.png) ESIC Compliances for Private

limited company

ESIC Compliances for Private

limited company

Applicability: If a Private Limited Company employs 10 or more employees

(whether contractual,

temporary, or permanent) on any day during the preceding 12 months, it becomes

eligible for ESIC

registration.

Employee & Employer Contribution: The employee's contribution towards

ESIC is a fixed

percentage of their wages, which includes basic pay, dearness allowance, and any

other allowances

on which ESIC is applicable. The current rate of employee contribution towards

ESIC is 0.75% of

their wages and the employer's contribution rate is higher than that of the

employee and is

currently set at 3.25% of the employee's wages.

Registration: Private limited company must register itself with the ESIC

within 15 days from the

date of the Act becoming applicable to it.

Monthly returns: The employer is required to file monthly contribution

details with ESIC. This

includes details of the employees, their wages, and the contribution made by

both the employer

and the employee.

Payment of Contribution: The employer is required to deposit the ESIC

contribution on a monthly

basis. The due date for payment is usually the 15th of the following month.

.png) What if ESIC Returns not filled on

time?

What if ESIC Returns not filled on

time?

* Late filing fees: The ESIC authorities may impose late filing fees for

each day of delay in filing

the returns. The late filing fees can vary depending on the duration of the

delay and the

number of employees covered under the ESIC scheme.

* Interest Charges: In addition to late filing fees, interest charges may

also be levied on the

outstanding amount if the ESIC contributions are not deposited on time.

* Maximum late fee: However, there is usually a maximum limit on the late

fee that can be

imposed. As of my last update, the maximum late fee for ESIC filings was Rs.5000

per return.

* Legal Consequences: Continued non-compliance with ESIC regulations may

lead to legal

consequences, including fines, penalties, and legal proceedings against the

employer.

.png) ESIC Returns due date

ESIC Returns due date

* For the Period April to September (First Half of the Financial Year):

The due date for filing ESIC returns for this period is generally on or before

November 12th of

The same financial year.

* For the Period October to March (Second Half of the Financial Year):

The due date for filing ESIC returns for this period is generally on or before

May 12th of the

Subsequent financial year.

.png) What is EPFO?

What is EPFO?

EPF stands for Employees Provident Fund, which is a social security and retirement savings scheme in India. It is regulated and managed by the Employees Provident Fund Organization (EPFO), a statutory body under the Ministry of Labor and Employment, Government of India. EPF is a compulsory savings scheme for employees in certain sectors and industries.

.png) EPFO Compliances for Private

limited company

EPFO Compliances for Private

limited company

* Applicability: If a Private Limited Company employs 20 or more

employees (whether contractual,

temporary, or permanent) on any day during the preceding 12 months, it becomes

eligible for EPFO

Registration.

* Employee & Employer Contributions: The employee's contribution rate is

fixed at 12% of their basic

salary, dearness allowance, and retaining allowance, subject to a maximum limit

specified by the

government. The employer is also required to contribute an equal amount to the

EPF scheme. The

employer's contribution rate is also fixed at 12% of the employee's basic

salary, dearness allowance,

and retaining allowance, subject to the same maximum limit as the employee's

contribution.

* Deposit of Contributions: Both the employee's and employer's

contributions must be deposited with

the EPFO on a monthly basis.

* Returns filings: The employer is required to file monthly EPF returns

with the EPFO, providing details

of the contributions made by both the employer and the employees.

* Issuance of EPF Statements: The employer is required to issue EPF

statements to employees showing

details of their contributions, interest earned, and other relevant information.

.png) What if EPF Returns are not filed

on time?

What if EPF Returns are not filed

on time?

* Late filing fees: Failure to file EPF returns within the prescribed

due dates may attract penalties

and late fees. The exact amount of penalties may vary based on the duration of

delay and the

provisions of the Employees Provident Fund and Miscellaneous Provisions Act,

1952.

* Interest Charges: In addition to late filing fees, interest charges

may also be levied on the

outstanding EPF contributions if they are not deposited on time.

* Legal Consequences: Non-compliance with EPF regulations could result

in legal action by the

Employees Provident Fund Organization (EPFO). This may include notices,

inspections, and

other enforcement measures by EPFO authorities.

* Accumulation of Dues: Delay in filing EPF returns may result in the

accumulation of dues and

liabilities, including contributions, interest, and penalties, which could pose

financial

challenges for the employer.

.png) EPF Return due date

EPF Return due date

15th date of every next month.

.png) Late fees

Late fees

For Employers with up to 5 Employees: No late fee is applicable for

employers with up to 5

employees.

For Employers with 6 or More Employees: For employers with 6 or more

employees, the late fee

for delayed filing of EPF returns is ₹100 per day of delay for each month of

default.

Accounting

Accounting is the process of recording, summarizing, analyzing, and reporting Financial transactions of a business or organization. It involves systematically Recording financial data to produce financial statements and reports that provide Insights into the financial health and performance of the entity. Private Limited Companies are required to maintain proper books of accounts, including records of all transactions, assets, liabilities, income, and expenses. The books of accounts should be kept at the registered office of the company and should provide a true and fair view of the company's financial position.